Date: 4 March, 2021 - Blog

Disgusted by the 2008/2009 Great Financial crisis, private investors disinterested of the stock market for more than a decade. But from early 2020 a cohort of retail investors managed to shake the established order of Wall Street. Not everyone is happy about it. Indeed, January 2021 has been the scene of major setbacks for some financial stars, namely in the world of short-selling Hedge Funds. Some argue that this retail investors’ renaissance spells the democratization of investing, the revolt of the millennial & Z generations against the boomers. Others consider this as just another temporary speculative phase fueled by cheap money. Let us try to figure out what is actually going on.

The support of structural and cyclical factors

The intense competition among US financial intermediaries has marked the end of the discrimination of ¨small¨ investors for three reasons.

- Size. Any investor can now buy just a portion of a stock. Pricy stocks, like Amazon for example, have therefore become accessible for retail investors.

- Fees. Commissions on trading, for example on smartphone applications like Robinhood, have disappeared. It has become painless for any investor to multiply trades virtually limitless each day, including on derivatives instruments.

- Leverage. Getting additional – borrowed – capital via margin loans has also become mainstream. Very little regulation exists for now.

Financial information and analysis have been commoditized in recent years. Most of it is also accessible to individuals. It is largely shared through social networks and financial platforms.

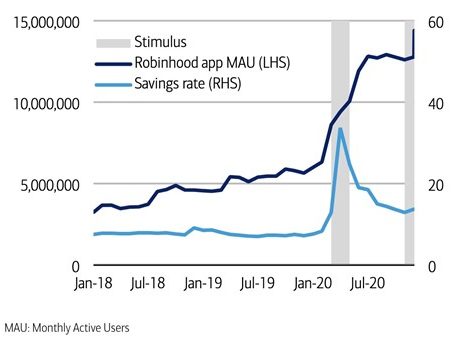

Free money, pandemic, and government checks. Sport betting has severely decelerated and households’ disposable income has risen, thanks to a collapse of discretionary expenses (closing of many service providers) and government ¨generosity¨. Lots of unemployed people now have ample free time to attempt earning money at Wall Street.

Evolution of Robinhood Monthly Active Users and government stimulus

Source: BofA Global Research, Bloomberg

Individual investors face much less competitive disadvantages vs institutions

Covid-19 pandemic and government checks exacerbated their cult for equities

A series of unquestionable victories

Warren Buffet, the guru of finance, sold last spring all his holdings in US airlines. In a surprising reaction, a well-organized cohort of little investors decided to massively invest in those stocks. Thanks to their synchronized purchases, they rapidly moved airline stocks much higher than when Buffet sold them. As of today, this strategy remains highly profitable.

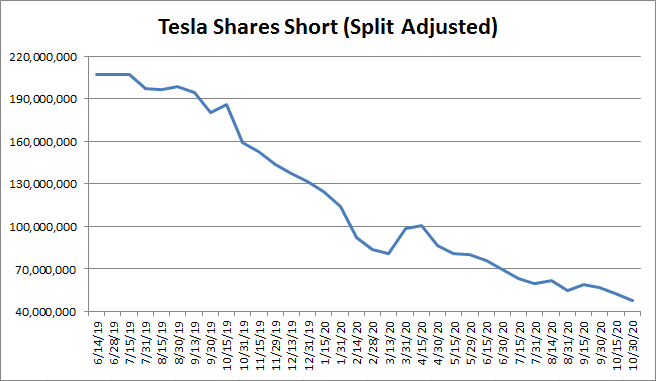

Tesla “Short Squeeze” was the first victory claimed by individual investors against hedge funds across social networks. According to reliable sources, short sellers that bet against the stock lost a massive $40 billion in 2020, making it the single most unprofitable short of the year.

Obviously, Tesla short sellers have literally capitulated !

We could probably see there the genesis of a targeting philosophy against Wall Street’s villains, here short sellers, which progressed in the last months, up to a paroxysm last January.

Unloved small and penny stocks. In 2020, value fund managers suffered large underperformance against their benchmark. Solid and regular retail flows propelled unloved value stocks, including micro caps. According to value fund managers, never before, so many loss-making small companies similarly thrived for so long out of any fundamental reason.

Gamestop, AMC, and Co. Last month, this saga led to i) abyssal losses for some concentrated hedge fund managers, ii) forced deleveraging of some market participants, and iii) a large reduction of exposure by Long/Short Equity funds globally.

Retail investors communicate and coalesce efficiently via social networks

Their unprecedented modus operandi through financial platforms makes them powerful

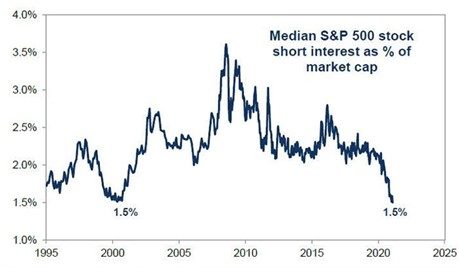

The HF’s strategy of short selling is probably getting close to a capitulation point

Last month, short interest was as low as post IT bubble burst

Source: FactSet, Goldman Sachs

A tricky dilemma for policymakers

Last January, during a short period of time, the fear rose that the stability of the financial system could be endangered, in sort of a remake of the LTCM drama. Indeed, the unprecedented volume and the speed of transactions had no commonality with the financial strength / depth of the financial intermediaries in charge of their execution. In less than a couple of weeks, some of them have been heavily recapitalized, and the collateral required by the clearing house adapted. This risk is now fixed.

US lawmakers are discussing new regulation to better frame hyper-active retail investors investment activities. The SEC also promised to scrutinize actions taken by brokers that may “unduly inhibit their ability to trade certain securities.” This resembles more a side-show than a prelude to new binding regulations.

The renaissance of retail investors is a delicate issue, with deep political roots (wealth inequality)

- Wall Street is experiencing a probing come-back of retail investors

- It does not look like a temporary epiphenomenon

- But it is exaggerated to call it a – new – major driver of equity markets