Date: 10 January, 2019 - Blog

The severe deterioration of financial conditions – say the widening of credit spreads – forced the Fed to consider softening the pace of its inevitable monetary policy normalization. A possible pause may prevent markets from collapsing. This is now urgently needed. Indeed, if financial markets and housing were to crash, this would eventually provoke a severe negative wealth effect, hence ultimately a rise in saving and a recession…

Early signs of US economy weakness, as well as financial markets’ correction reduce Trump room to maneuver vs. China. The truce of trade war has better chances to be prolonged, if not turn into some sort of a ¨trade deal¨.

A silent Trump (actually a bold assumption), would refrain markets from concluding that Fed independence is at risk…

A weaker Trump should be more inclined to soften his stance on trade, while remain firm on security / intellectual property

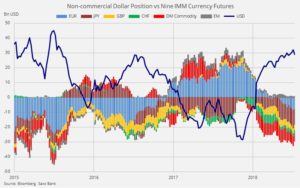

Extremely long USD speculative positions on the verge of reversing ?

Everybody and his dog have been long the USD in 2018. This situation is reminiscent of 2015, when the Yuan similarly experienced a serious weakness phase. This extreme positioning of institutional investors resulted from a) the outstanding wealth of US economy in 2018, and b) the carry trade (speculative / complacent) mentality of global investors. Similar patterns were observed during last years through long-lasting overweight in US equities, financials, FAANGs, high yield, etc. Most of them have recently been dramatically unwound. USD might prove the last shoe to drop in 2019. The recent strength of emerging currencies and of the JPY vs. the greenback, as well as gold relative strength are early signs of it.

The unwinding of long USD positions may change markets sentiment and developments

A weaker USD might open the door for lower policy rates… in China

However, it would (further) complicate the task of the ECB

- Trump chaotic policy has not (yet) impaired seriously the US economy

- The odds are rising for a dramatic change in US policy mix and politics, but the clock is loudly ticking

- A weaker USD would relieve markets and fuel a global reflation trade (à la 2016/17)

- It would favor a US yield curve steepening and a reduction in yield differential with the EUR