Date: 5 February, 2021 - Blog

Financial markets are a-washed with excess liquidity, even more so since the Covid-19 crisis. Negative real interest rates favor leverage and… speculation. A consequential asset price reflation regime (APR) is actually in place since the aftermath of the Great Financial Crisis. It has accelerated since H2-20.

Untamed investors’ greed is emerging

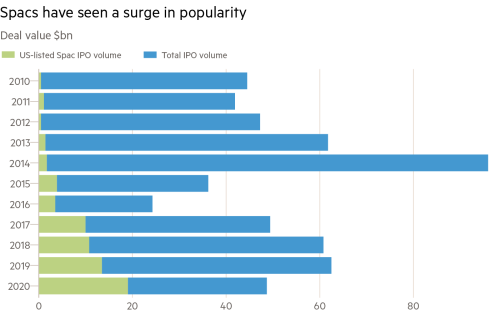

The outstanding success of IPOs and SPACs deserves careful attention

SPACs echo the dot.com bubble

Also known as “blank check companies”, SPACs – special purpose acquisition company – are companies with no commercial operations. They are formed to raise capital through an initial public offering (IPO). Their sole purpose is to acquire private existing companies. At the time of their IPOs, SPACs have neither existing business operations, nor defined targets for acquisition.

In a way, SPACs resemble certain segments of Private Equity. Practically, SPACs have two years to complete an acquisition or they must return their funds to investors. SPACs facilitate the quotation of companies that would otherwise face too high regulatory / compliance requirements. They also tend to embed opaque – say extremely favorable – schemes of remuneration for their owners and promotors…

Their selling proposition is very appealing: with the help of financial / business experts they filter companies at an inflection stage of their cycle. Most of the money they raise is expected to be invested in ¨unicorns¨. For instance, auto-tech start-ups have been a particular favorite, with names like Nicola. As a matter of other examples regarding ¨fintechs¨, 1) the former Credit Suisse chief executive, M. Thiam is launching a $250m SPAC to invest ¨in financial services businesses in the developed and developing world¨ and 2) Bakkt Holdings, a cryptocurrency platform, announced plans to go public thanks to a ¨blank-cheque company¨. Sounds good, right? Actually, SPACs emerged lately as major fund raisers.

Source: Dealogic, FT

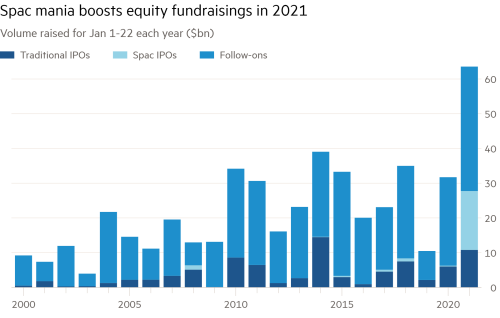

Source: Refinitiv, FT

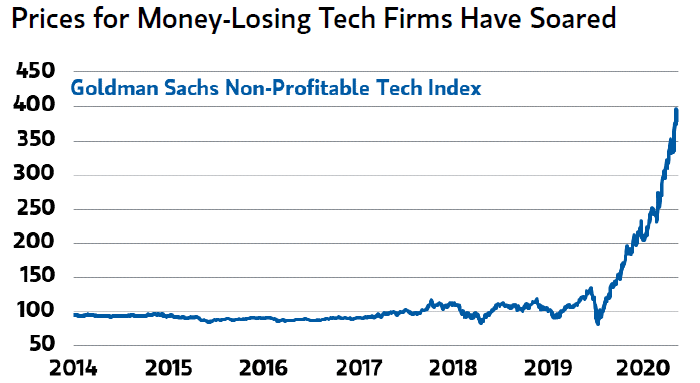

When prices no longer matter…

The current investment regime (APR) is visibly generating ¨bubbly¨ excesses. Indeed, the ongoing ¨mania¨ for tech unicorns is indiscriminate. Lots of targeted companies are loss-making. They have lately been acquired irrespective of the price to pay. See below graph.

This mindset is reminiscent of the late 90’s, when it sufficed for a company to present itself as a member of the ¨internet revolution¨, for its stock price to sky-rocket. Veterans probably remember the iconic story of ¨pet.com¨. At that time, this mania prefigured the burst of the IT bubble.

Source: Bloomberg

According to Goldman Sachs, SPACs drained a firepower of about $70bn in 2020, which translates into $300bn, when considering the potential leverage of their operations…

¨Free money¨ is exacerbating unrealistic investors’ expectations

By selling flamboyant dreams, SPACs have a strong power of attraction, namely for unexperienced / retail investors

If history is any guide, SPACs have – very rarely – fulfilled expectations. According to a Financial Times analysis of US SPACs between 2015 and 2019, these cash shell structures proved a dicey bet for ordinary investors. Indeed, the majority lie below $10 per share, the standard price where they first sell their shares to the public.

- Investors hunt for growth and fear of missing out are reaching climax levels

- SPACs symbolize the speculative mania developing in specific ¨hot¨ segments of the financial markets