Date: 7 September, 2020 - Blog

China has been preparing the de-anchoring and the internationalization of its currency since a decade. The glamorous – and controversial – Silk Road project is the most visible vector of it. One must also consider the opening-up of its capital market and the Stock-connect initiatives, as well as the quotation in Yuan, of oil and gold, at Chinese Stock exchanges. On the macro-side, the PBoC exited its USD peg for a managed one (on a basket of currencies) and has formally opted for a monetary policy that diverges from the Fed.

The hardening of Trump administration will only strengthen the resolve of Xi. The election of a new US President / a different Congress is unlikely to stem this structural undocking. Foreign capital has been pouring into Chinese assets lately, in search of yield and of de-correlation.

Yuan’s metamorphosis is accelerating

The eventual birth of a digital renminbi

The People’s Bank of China initiated a study of a digital currency as soon as in 2014. It is now contemplating the launch of a Digital Yuan, which would be a third kind of money issued by a central bank, next to cash and banks reserves. Contrarily to the Libra or the Bitcoin, there won’t be any difference between the value of units of digital and physical Yuans.

Just like India, China essentially aims at removing physical cash. A digital Yuan would complicate capital flight and money laundering. It would also be more easily controllable by authorities… To ring-fence the banking sector from outflows, this digital Yuan will a) use a two-tier system based on distributors (commercial banks and payment platforms) and b) not receive interests by the PBoC.

The digital renminbi is not a challenger to ¨en vogue¨ crypto currencies

It is no alternative to the global payment system: it is essentially another channel for payments through banks and on-line platforms (like WeChat/Alipay)

Towards a Renminbi gold-standard?

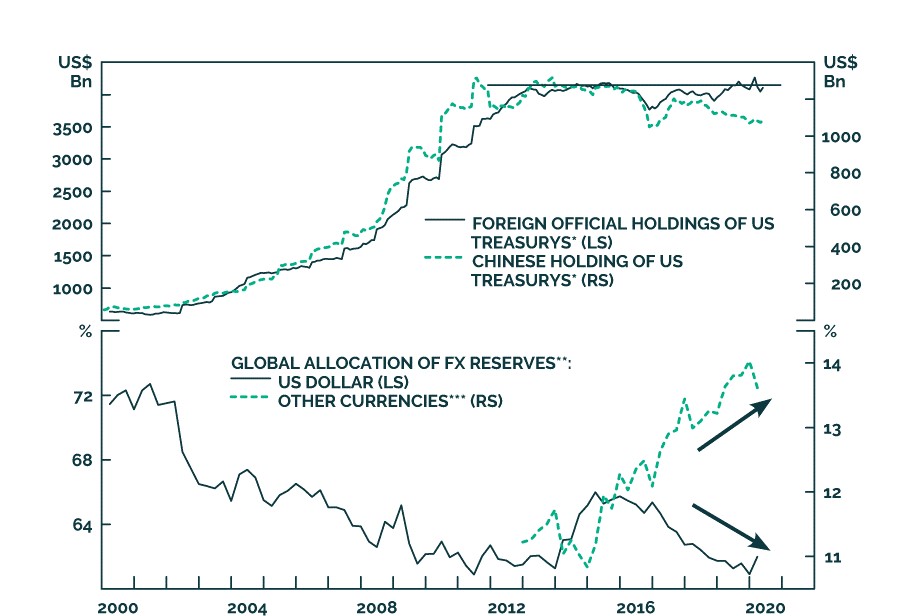

The stock of US Treasuries held by the PBoC peaked in 2010 and then plateaued up to 2015, i.e. the year of its ¨devaluation¨. Since 2016, the share of the USD in Chinese FX reserves relentlessly decreased. Other currencies, which then represented 11% of the total, now approach 14%.

Source: BCA

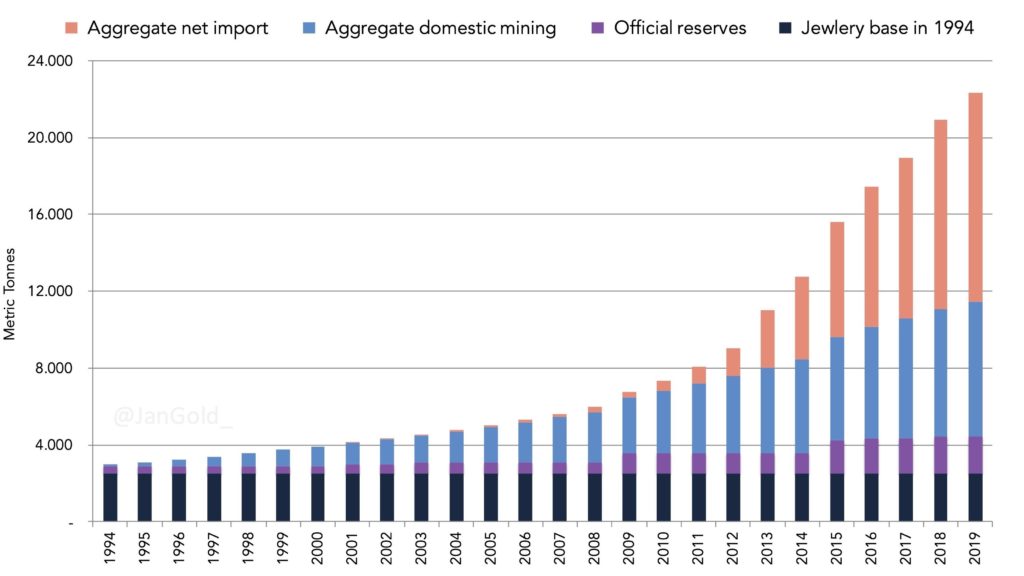

Comprehensive data on the Chinese gold reserves are not officially published. What we know is that, in 2002, China freed up its gold market with the opening of the Shanghai Gold Exchange. A few years after the great financial crisis, China actually became a significant player in the global gold market. Indeed, its imports significantly grew since 2010 to literally explode in 2013. Over time, China’s central bank has facilitated physical gold ownership, by allowing the people to directly access the wholesale market and trade fine gold at lowest spreads. A smartphone application called “Yijintong” was also launched to ease further gold trading for everyone.

Estimated total Chinese gold reserves

Source: VOIMA

Rumors abound that the PBoC holds at least twice the amount of the gold it officially discloses. Underreporting gold reserves would allow the PBoC to accumulate at lower prices. Raising gold weighting is a good hedge against a debasement of the USD, which still represents a large portion of the central banks’ reserves.

The love story of China for gold has solid roots

Ultimately, China may prepare some anchoring of the Yuan with gold

The inevitable financial alliance of ¨the rogue¨

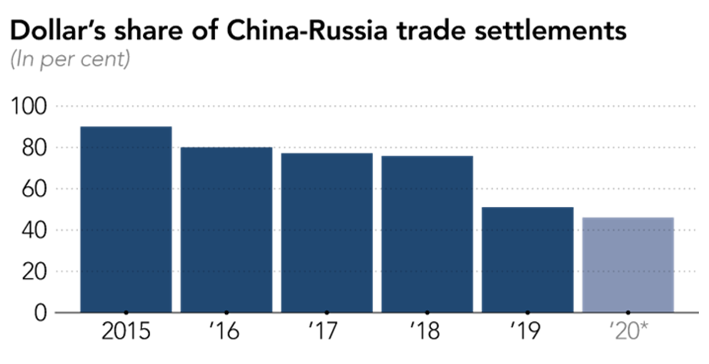

In 2014, China and Russia signed a first 3-year currency swap worth about $25bn. It was rolled over in 2017. In 2019, both countries agreed to develop an alternative payment mechanism to the US dominated Swift. Subsequently, the dollar’s share of trade between China and Russia fell, for the first time on record, below 50%. The € was the prime beneficiary with a – rising – share of 30%. Russia is said to have acquired no less than a quarter of the world’s Renminbi reserves.

Dollar’s share of China-Russia trade settlements

Source: Russia’s Central Bank and Federal Customs Service

China and Russia are pursuing a joint de-dollarization process

Mega (geo)-political trends will accentuate this process

- The launch of a digital Yuan would confirm the financial innovation skills of China

- Next couple of years, the Yuan will not challenge the trade and reserve currency status of the USD

- But still, the € and Yuan resurgence will eventually affect, in the medium-term, the USD prominence