Date: 6 October, 2022 - Uncategorized

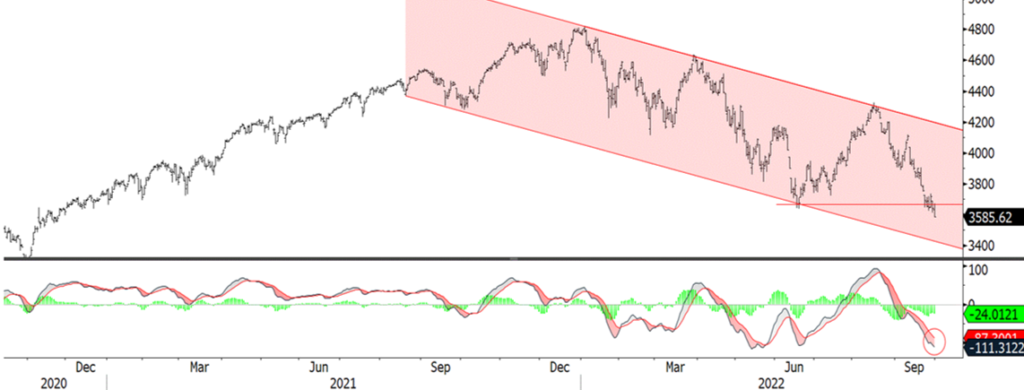

The S&P 500 is in an oversold position (MACD) and the Bollinger lines are moving apart

It would become interesting to initiate a tactical buy signal on equities. But by breaking the support at 3,675, we can expect that the correction continues towards 3,440-3,400 (another 4% drop). The various Advance-Decline oscillators show that demand remains weak on the upsides. We fear a capitulation of retail investors who have so far not

panicked; worries about the real estate sector could push them to sell stocks to protect their overall fortunes. Are Apple’s stock market weaknesses the beginnings of a capitulation by retail investors?

S&P500

Source: Bloomberg

In September, the S&P 500 fell 9.3%, bringing the 2022 correction to 24.8%. The MSCI World corrected by 26.4% and the Euro Stoxx 50 by 22.8% (in EUR). Buying opportunities remain in a bear market configuration for the time being.

To begin to become more constructive on equities, it would be necessary that:

- Investors perceive that the Fed is coming to the end of its restrictive process and announces the success of its fight against inflation. The various governors of the Fed are not at all in this logic. In August, the core PCE, the indicator followed by the Fed, rose to 4.9%, well above its long-term target of 2%.

- Investors have a better visibility on the evolution of corporate profits. Factset expects US profits to grow by 2.9% in 3Q22 compared to +9.8% at the end of June. We are therefore clearly in a reduction of growth estimates. Investors will therefore await the US results which will begin on October 14th with the major banks.

Nike has just published better-than-expected results, but the group is posting a sharp rise in inventories which should weigh on profits in the coming months.

Today, we have to take geopolitics into account

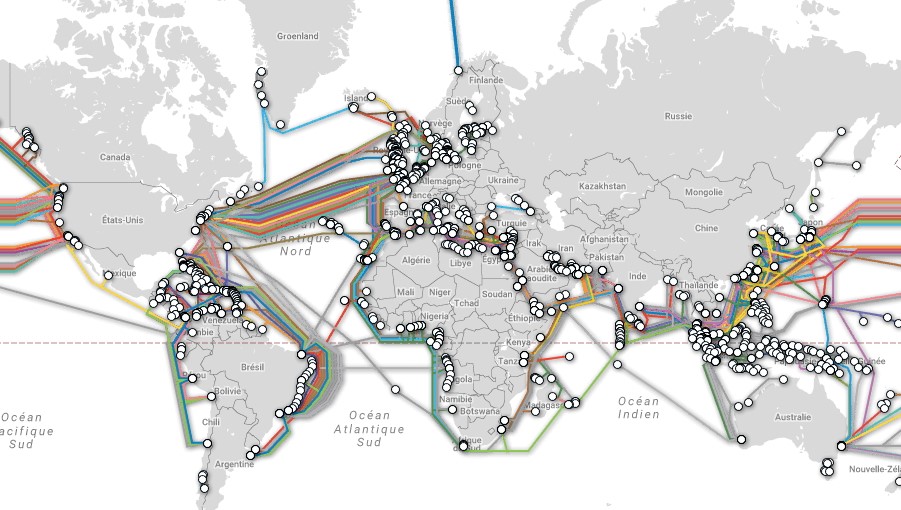

The Russia-Ukraine conflict is becoming a Russia-West conflict with major energy and food disruptions. Sabotage on Nord Stream 1 and 2 could announce even more serious events such as cuts in the submarine cables used for telecommunications, the internet and electricity. A hybrid war is taking place, that is to say the use of unconventional means that are more in a gray area to intimidate or send messages that are difficult to attribute.

Continents are interconnected by internet, telecommunications and electricity cables that pass under the seas. If damaged, unprecedented chaos would affect many countries around the world and Europe in particular. All intercontinental electronic communications pass through submarine cables. There are more than 400 underwater cables. SWIFT financial transactions pass through these cables. Another source of concern, the intelligence which uses these cables to exchange strategic information for the security of countries. These devices are closely and constantly monitored by the naval vessels of European countries, especially since Russian military vessels have been seen near the Irish coasts through which these information highways pass. The Celtic Norse and AEConnect-1 submarine telecommunications cables that connect Ireland to the United States are very important, as all global communications and financial transactions pass through these cables. The other target that is less talked about could be the submarine electric cables that allow electricity to be transported from one country to another. Just a year ago, the world’s longest link, 720 kilometers, entered service between Norway and the United Kingdom.

Map of submarine cables (UN GEM)

Last Friday, EU countries reached an agreement to recover part of the “superprofits” of electricity producers (nuclear and renewable energies) to redistribute them to consumers. But they remain divided on capping the price of Russian gas imports because it would limit supply, so gas availability and security of supply are more important than price.

The German RWE will acquire the American producer of green electricity Consolidated Edison for $6.8 billion. It is one of the largest renewable energy operations in the United States. This acquisition will double RWE’s renewable energy portfolio. RWE has revised its profits for 2022 up by 30% thanks to higher electricity prices. Superprofit taxes will not prevent electricity producers from making extraordinary profits in 2022 and probably in 2023, and it will accelerate investments in green energy. RWE has announced its Growing Green Strategy plan which involves total investments of €50 billion by 2030. The Qatar Authority Fund will support this acquisition with €2.4 billion. We should see other large electricity or oil producers acquire smaller green energy companies.

This Wednesday, OPEC+ will consider an oil production cut of 1 million barrels/day. It is important. Their argument is that the global economy will slow down sharply, as Brent prices have fallen from $125 to $85 in 4 months. But in our view, Saudi Arabia is trying to put pressure on Western countries that want to cap the price of Russian oil. If this system were to work, a cartel of buyers could exist, which fears OPEC+.

European defense stocks have been recovering since mid-September, but the rise is sluggish. Orders arrive, but the impact on results will only be seen from 2023. First, the purchase of armaments by States takes time, because it is (very) expensive and it is necessary to integrate the arming with its partners and with NATO in particular for those who are in the Atlantic Alliance. Then, the Defense theme is not driven by structured products as we have seen with the energy transition or the Metaverse for example. Europe has announced very significant increases in defense budgets over several years. Weapons directors from Western allies met last week to discuss the acquisition of interchangeable systems. The United States is pushing the EU to strengthen its European defense industrial capacities, which are insufficient, as for the United States elsewhere. Poland had to buy hundreds of tanks and other equipment from South Korea. Germany’s strong comeback in military affairs rekindled an old rivalry with France in the arms industry. Germany is in a hurry and no longer hides its desire to modernize if necessary with American and Israeli technologies.

- We are close to a rebound for equity indices. In 2 weeks, we will come out of the unfavorable seasonality and enter the results publication period.

- Overweight electricity producers, European

- Nexans and Prysman could benefit from geopolitical tensions over submarine cables

- Overweighting defense takes a bit of patience