Date: 26 January, 2023 - Uncategorized

Murphy’s law is an adage or epigram that is typically stated as: “Anything that can go wrong will go wrong.”

Last year was particularly devastating for large, balanced global portfolios. It was the worst such carnage in decades, resulting from the concomitant correction in bond and equity markets. Fortunately, the odds of a renewed Murphy’s year in 2023 seem low, first from a purely statistical point of view. But more importantly also in terms of the dynamics of the major fundamental variables.

Early signs of the end of the alert

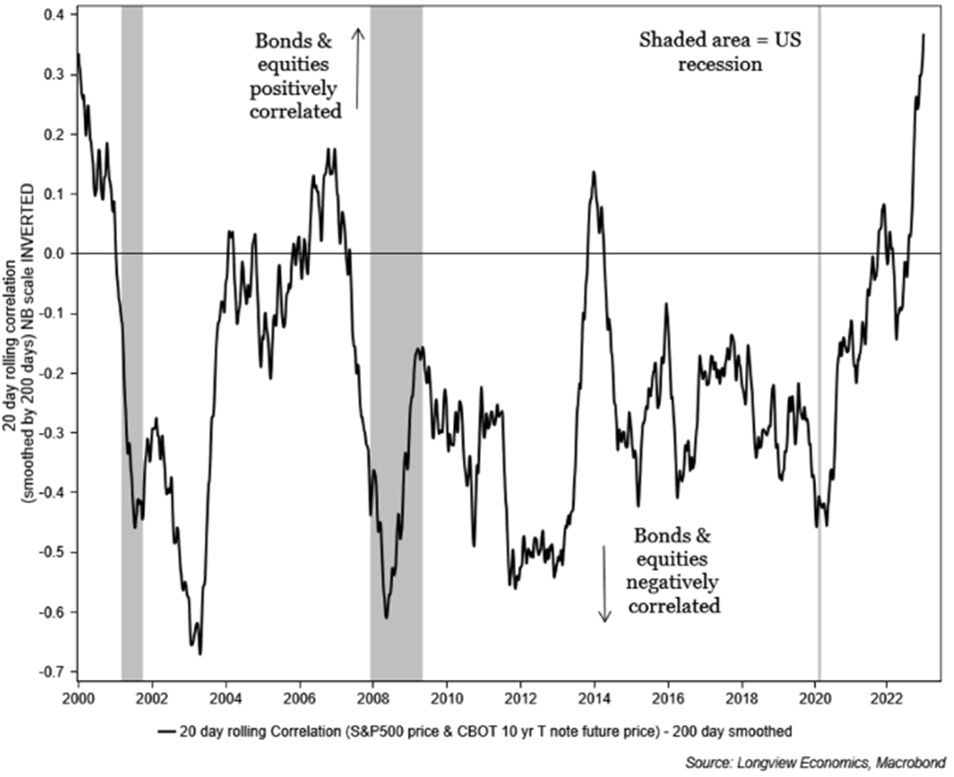

This rout should be seen in the context of the impromptu eruption of inflation, which, dare we say it, literally galloped into 2022 in the major economies, with the notable exception of China and to a lesser extent Japan. The consequential flip-flop in the correlation between stocks and (sovereign) bonds illustrates this perfectly. Long rooted in deep negative territory thanks to the deep and long disinflation, it has now comfortably established in positive territory (+0.35) for several months.

At this juncture, the Big Question is:

- Have we effectively returned to a fundamentally inflationary macroeconomic regime? If so, such a positive correlation will persist

- Or have we experienced a one-off shock (repricing / normalization) linked to the sudden end of financial repression? In which case the correlation could move back

Two decades of (Sovereign) Bonds and equities correlation

Either of these two scenarios will obviously have diametrically diverging consequences for large balanced portfolios

The latest deceleration of input and output prices provide a silver lining

Odds of a global downturn are elevated

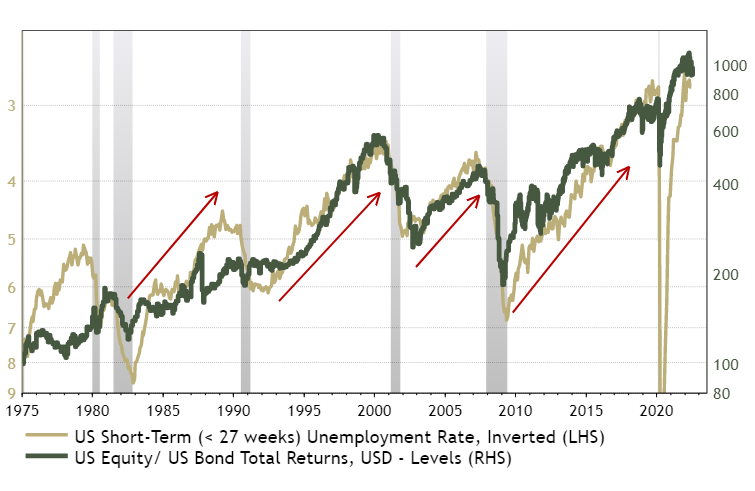

The tightening of monetary policy and financial conditions in the USD and EUR zones have been considerable and rapid. According to the leading indicators and ISM indices, the economy will weaken significantly in 2023. No matter what the defenders of a soft landing say, the Fed wants / needs to slow down the job market, hence consumption (demand), to calm down price increases.

Even in the event of a ¨shallow and short¨ recession, unemployment will rise. In the US, for example, experts (and even the Fed) see it rising from around 3.5% now to 4.5-5%. Incidentally, this is the level at which the NAIRU (Non-Accelerating Inflation Rate of Unemployment) would be located…

Improving employment supports equities; higher unemployment benefits bonds

Source: ASR, Refinitiv Datastream

Upcoming downturn may fuel bonds outperformance

Disrupting factors may emerge, medium-term

With inflation deceleration in 2023, scenario B) has larger odds to unfold for now, but…

China’s health double or nothing allows us to hope for a significant – cyclical – growth rebound from the second half of the year if it is successful. Consumption should pick up and the bottleneck on production lines should disappear. An overly violent recovery could even re-fuel the rise in commodities, hence inflation!

Once the 2023 downturn ends, the three secular inflation drivers – higher consumer goods (deglobalization), labor costs (great resignation) and energy prices (corrosive geopolitics, green transition) – will resurge. The re-action of central banks to a possible stabilization of inflation around 3 or 3+% would be crucial. Burns or Volker, that may would be the ultimate issue to address!

In 2023 we expect the equity-bond correlation to return to a neutral if not slightly negative stance

But 2024 may be more hectic for asset prices developments and correlation

- The upcoming – cyclical – deceleration of inflation should allow bonds to perform well / outperform in a first phase

- Equity markets’ performance is more unpredictable. It will depend primarily on the nature/depth of the slowdown / magnitude of the decline in profits

- In any case, a remake of last year catastrophic performance, due to positive bonds and equities correlation, seems highly unlikely